rhode island tax rates 2021

Rhode Island Estate Tax. The 2021 TDI Contribution Rate was 13 percent.

Rhode Island S 10 Safest Cities Of 2022 Safewise

Printable Rhode Island state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

. A Interest on the balance due For failure to pay the tax on time interest at the rate of 18 01800 per year. The TDI Taxable Wage Base for Rhode Island employees will be 81500 in 2022. Everything You Need to Know - SmartAsset The Rhode Island estate tax rates range from 0 to 16 and applies to estates valued at 1537656 and aboveThe federal estate tax may also apply on top.

2021 RI-1065 - Rhode Island Partnership Income Tax Return SPECIFIC INSTRUCTIONS. Providence Rhode Island 02903. Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

Commercial Tax Rate 1542 - 000 1542 Estimated Property Tax Rate - Please note that under the new tax cap law the actual levy is adopted and the rate. Line 12 - Interest and Penalty Calculation Enter the total of a b and c on this line. FY2022 Tax Rates for Warwick Rhode Island FY2022 starts July 1 2021 and ends June 30 2022 Residential Real Estate - 1873 Commercial Industrial Real Estate - 2810 Personal Property - Tangible - 3746 Motor Vehicles - 3000 Motor vehicle phase out exemption.

Uniform tax rate schedule for tax year 2021 personal income tax Taxable income. The base state sales tax rate in Rhode Island is 7. 119 per calendar year No monthly fee.

FY 2021 Rhode Island Tax Rates by Class of Property Tax Roll Year 2020 Represents tax rate per thousand dollars of assessed value. EzPaycheck 2021 2022 Bundle Special Offer 139 Regular price. The 2022 state personal income tax brackets are updated from the Rhode Island and Tax Foundation data.

Before the official 2022 Rhode Island income tax rates are released provisional 2022 tax rates are based on Rhode Islands 2021 income tax brackets. Any income over 150550 would be taxes at the highest rate of 599. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. CITY OF NEWPORT RHODE ISLAND FISCAL YEAR 2021 PROPOSED BUDGET GENERAL FUND REVENUES - 1 - 2019 FY2020 FY2021 Dollar DESCRIPTION ACTUALS ADOPTED PROPOSED Change. Tax Rate Income Range Taxes Due 375 0 to 66200 375 of Income 475 66200 to 150550 248250 475 599 150550.

Or 15 00150 per month shall be assessed. Rhode Island sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Exact tax amount may vary for different items The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

The SUI taxable wage base for 2021 is 24600 26100 for maximum rated employers up from 24000 25500 for maximum rated employers for 2020. 2021 Tax Rates. 75 of NADA Value and a 5000 Exemption All rates are per 1000 of assessment.

2022 Tax Rate 11 percent 0011 The Temporary Disability Insurance contribution rate will be 11 percent for calendar year 2022. Rhode Island Rhode Island Income Tax Rate 2020 - 2021 Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. This is an increase of 7500 101 from the 2021 taxable wage base of 74000.

Over But not over Pay percent on excess of the amount over 0 66200 -- 375 0 66200 150550 248250 475 66200 150550 -- 648913 599 150550. Find your Rhode Island combined state and local tax rate. The income tax is progressive tax with rates ranging from 375 up to 599.

66200 150550 375 b Multiplication Taxable Income line 7 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 252882 RHODE ISLAND TAX COMPUTATION WORKSHEET a Enter the amount from RI-1040 line 7 or RI-1040NR line 7 Amount 25200 25250 946 25250 25300 948. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax Counties and. Your average tax rate is.

The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. The Rhode Island State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Rhode Island State Tax Calculator. Rhode Island Income Tax Calculator 2021 If you make 135500 a year living in the region of Rhode Island USA you will be taxed 28671.

The rate for new employers will be 116 percent including the 021 percent Job Development Assessment. The 2021 SUI tax rates were assigned based on Rate Schedule H with rates from ranging from 099 to 959 up from 069 to 919 for 2020 on Rate Schedule F. The state income tax table can be found inside the Rhode Island 1040 instructions booklet.

Local tax rates in Rhode Island range from 700 making the sales tax range in Rhode Island 700. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

40 rows 3470 - apartments with six or more units 2300 - estates farms time shared condos seasonalbeach property residential vacant land one-family residences residential buildings on leased land residential condos farmforestopen areas mobile homes two-family properties occupied by the owner. Try ezPaycheck now Buy it now Withholding Formula Rhode Island Effective 2021 Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying.

Assessment Date December 31 2019 CLASSES.

Rhode Island Sales Tax Small Business Guide Truic

Rhode Island Estate Tax Everything You Need To Know Smartasset

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

40 Ranking The States By Fiscal Condition Rhode Island Mercatus Center

Rhode Island Retirement Taxes And Economic Factors To Consider

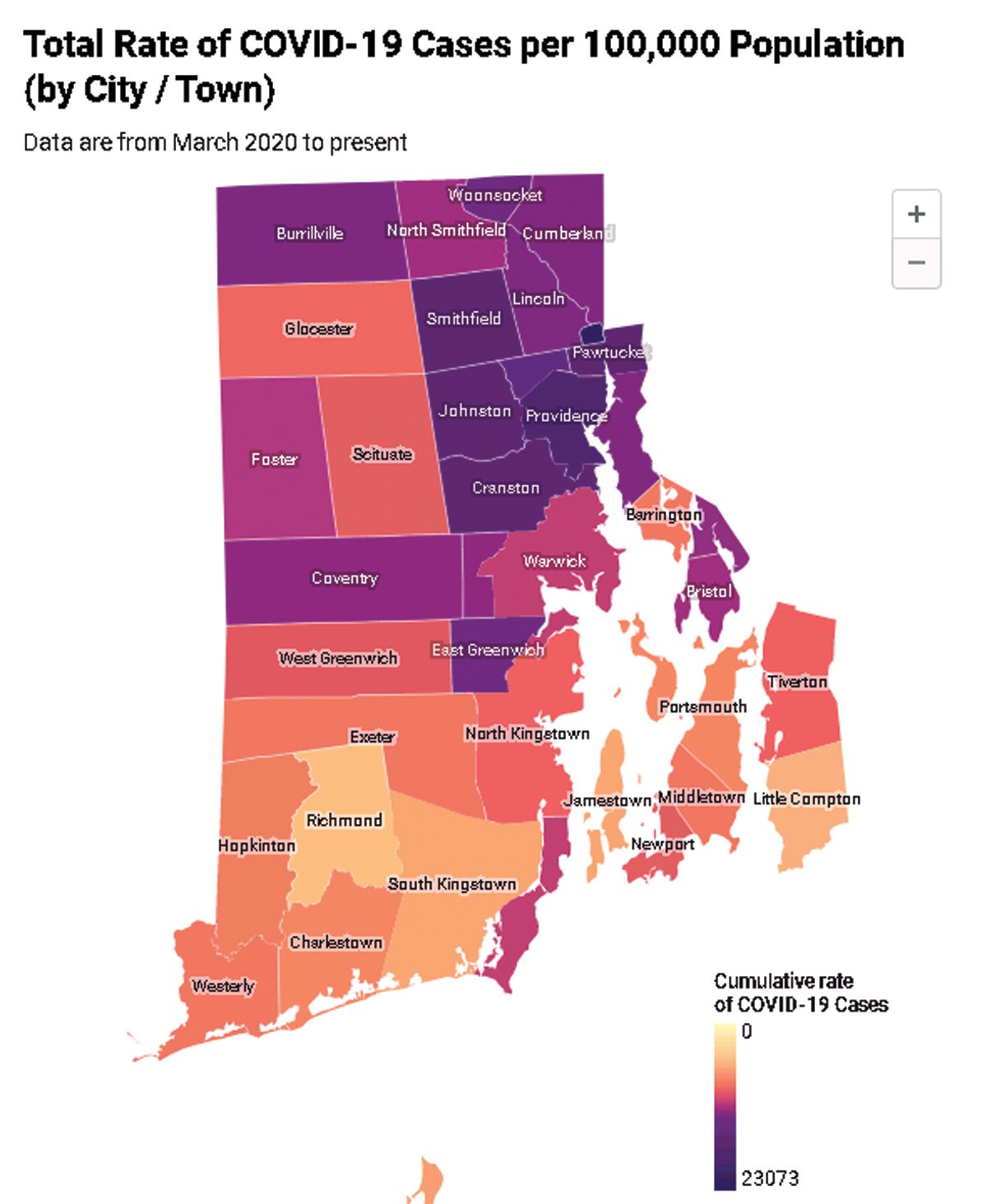

Johnston Among Rhode Island Communities Hardest Hit By Covid 19 Johnston Sun Rise

Rhode Island Income Tax Calculator Smartasset

Historical Rhode Island Tax Policy Information Ballotpedia

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Rhode Island Income Tax Brackets 2020

Covid 19 Information Ri Division Of Taxation

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Discover 20 Of The Most Interesting Facts Of Rhode Island Economic Ones Too

R I Keeping Unemployment Insurance Tax Rate Unchanged In 2022 Providence Business News

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Climate Change In Rhode Island Wikipedia

Rhode Island Aca Reporting Deadline Rhode Island Island Health Plan